21 January, 2026

Demographic Transition and State Finances in India

Sun 25 Jan, 2026

Context

The Reserve Bank of India (RBI) has released its annual report titled “State Finances: A Study of Budgets of 2025–26”, which focuses on the theme “Demographic Transition in India — Implications for State Finances.” The report provides a timely assessment of how changing population age structures across Indian states are emerging as a critical determinant of their fiscal health and long-term economic sustainability.

Understanding India’s Demographic Transition

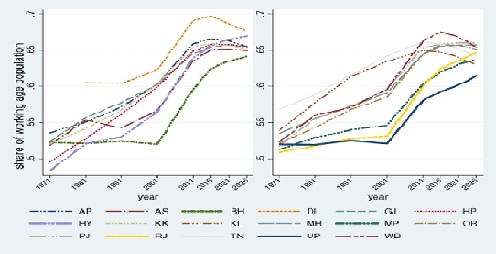

- India is currently at a pivotal demographic stage, with a median age of around 28 years, indicating that the working-age population is at or near its historical peak. However, this national average conceals significant inter-state disparities.

- Some states continue to experience a youth bulge, while others have already entered an ageing phase. The RBI report highlights that these demographic variations are no longer merely social indicators but have become key drivers of state-level fiscal outcomes.

Divergent Demographic Profiles Across States

The report categorises Indian states broadly based on their demographic trajectories:

- Youthful States such as Bihar and Uttar Pradesh still have a rising share of working-age population. These states enjoy a longer demographic window, offering opportunities for sustained growth if adequate investments in education, health, and skills are made.

- Intermediate States like Telangana and Uttarakhand are witnessing a gradual slowdown in the growth of their working-age population. Their demographic dividend is narrowing, making timely policy intervention crucial.

- Ageing States such as Kerala and Tamil Nadu have crossed the demographic turning point. The proportion of working-age population has begun to decline, while the elderly population is increasing rapidly.

These divergent paths imply that a uniform fiscal or social policy approach across states is neither efficient nor sustainable.

Fiscal Implications of Demographic Change

The RBI report underlines several ways in which demographic transition is reshaping state finances:

1. Shrinking Tax Base in Ageing States

As the labour force contracts in ageing states, long-term economic growth potential weakens. Slower growth translates into lower tax buoyancy, constraining states’ revenue-generating capacity.

2. Rising Committed Expenditure

- Ageing states face growing pressure on committed expenditures, especially pensions and interest payments. The report notes that in 2024–25, ageing states allocated nearly 30% of their social sector spending to pensions, reducing fiscal space for developmental expenditure.

3. Increased Fiscal Vulnerability

- States with ageing populations tend to have higher debt-to-GSDP ratios and elevated interest payment-to-revenue receipt ratios, making them more vulnerable to macroeconomic shocks.

- In contrast, youthful states face a different challenge—while their fiscal burden from pensions is lower, failure to invest adequately in human capital can result in unemployment, informality, and social instability, eventually straining public finances.

Policy Imperatives Highlighted by the Report

The RBI stresses that demography-sensitive fiscal strategies are essential:

- For Youthful States:

Massive and sustained investment in education, skilling, healthcare, and job creation is non-negotiable to convert the youth bulge into a productive workforce.

-

- For Intermediate States:

A dual strategy is required—maximising growth during the remaining demographic dividend while gradually building social security and healthcare buffers for the future.

- For Ageing States:

Policies should focus on developing the “silver economy” by extending working lives, aligning retirement ages with rising life expectancy, and encouraging flexible work arrangements for older citizens.

Broader Significance

- The report reinforces the idea that demography is increasingly shaping fiscal federalism in India. States are entering different phases of demographic transition at different times, implying that future intergovernmental transfers, fiscal rules, and social sector policies must be sensitive to these structural realities.

Conclusion

- The RBI’s analysis underscores that India’s demographic dividend is time-bound and unevenly distributed.

- While youthful states must act swiftly to harness their potential, ageing states need to recalibrate fiscal and labour policies to maintain sustainability. Recognising and responding to these demographic realities will be central to ensuring stable state finances and inclusive growth in the decades ahead.

|

About the Reserve Bank of India (RBI)

|